- Amazon is taking longer to pay out suppliers: It now takes an average of 28 days for a seller to get paid out for a sale.

- Amazon’s’ cash conversion cycle can hinder sellers’ ability to grow. Waiting 28 days to get paid means you can’t order more inventory, pay suppliers, spend on ads, and reinvest in your business.

- Ideally, an Amazon seller’s cash flow cycle will create a steady stream of inventory and sales. Getting paid out daily via Payability can help you do that. WIth Payability, you get 80% of your money the day after you ship.

One of the toughest parts of growing an online business is managing cash flow. It’s even harder now with growing inflation and persistent supply chain problems.

How long do you have to wait to buy another round of inventory? Do you have enough cash on hand to weather an increase in shipping, inventory, and/or marketing costs?

Without healthy cash flow, not many businesses can survive. In fact, 82% of failed businesses cite cash flow problems as a main factor.

It’s vital to track your cash flow and understand when it’s worsening or improving and why. Many sellers use a metric like cash conversion cycle (CCC) to better understand their operations and overcome cash flow issues.

In this guide, we’ll define the cash conversion cycle, how to calculate it, and how you can compare your own CCC to other online sellers.

What is the Cash Conversion Cycle (CCC)?

The cash conversion cycle (or cash cycle) measures the time in days it takes a seller to convert their inventory into cash from new sales. It’s a working capital metric that shows your selling efficiency and health of your business.

It encompasses these three main stages:

- Buying inventory

- Selling inventory and collecting cash from sales

- Paying bills to vendors for inventory purchased

CCC shows how long cash is tied up in each stage of the sales processes before it turns into cash received.

What Cash Conversion Cycle Shows Sellers

The faster a seller can move through the stages of CCC, the quicker they’ll have cash available to operate their business and do things like buy more inventory, pay down debts, or spend on anything else.

By regularly monitoring this metric, you can watch for any operational issues that could be slowing down your cash flow.

A high ( i.e. slow) CCC can indicate you have money tied up on at least one stage, like inventory that sits for long periods before it sells. When this happens, you’ll wait too long to generate enough cash to keep your business moving and growing.

How to Calculate Your Cash Conversion Cycle

Calculate your CCC using the following formula:

CCC = Days Inventory Outstanding (DIO) + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO)

CCC = DIO + DSO – DPO

DIO

DSO=10*34

DPO=((10*60))

- DIO = (average inventory / cost of goods sold x number of days)

- DSO = (accounts receivable x number of days outstanding / total credit sales)

- DPO = (accounts payable x number of days outstanding / cost of goods sold)

For example, from 2010 to 2021, Walmart had an average CCC of 8.18 days. Home Depot’s was 39.4 days.

In the CCC formula, DIO and DSO relate to your cash inflow, while DPO follows your cash outflow. It shows how cash is converted into inventory (accounts payable), then to sales (accounts receivable), and then back into cash on hand.

What Does a Negative Cash Conversion Cycle Mean?

For most sellers, your CCC will be a positive number. However, highly-efficient online sellers could have a negative CCC.

A negative number indicates that a merchant can receive payments from sales before it has to pay its suppliers for inventory. This happens when you can sell inventory quickly, receive payment from customers, all while having a longer payback date to your suppliers.

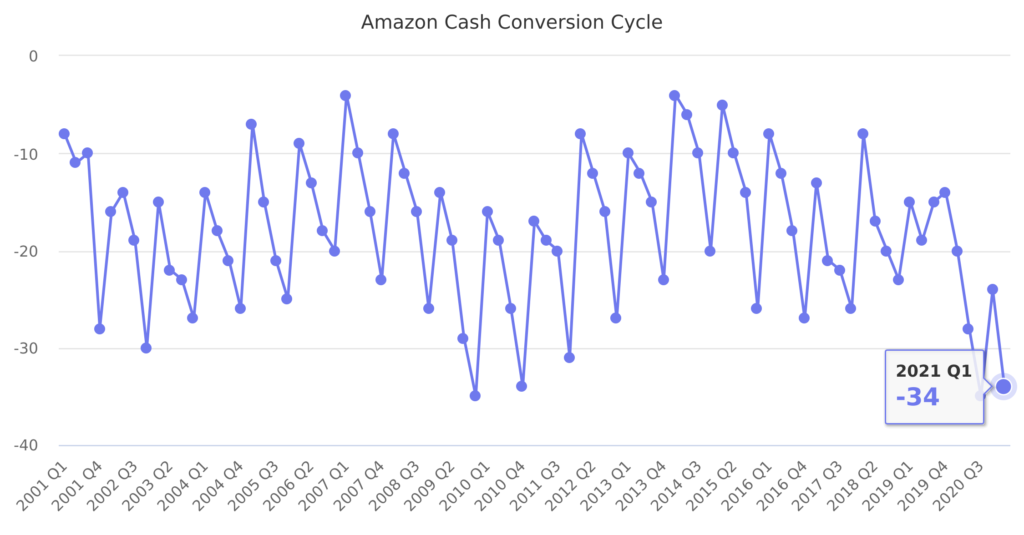

For example, Amazon had an average CCC of -13.28 days from 2009 to 2020. In the last quarter on record, its CCC has grown to -28, which can be a big drag on cash flow for sellers using that platform.

How to Compare Your Cash Conversion Cycle to Other Sellers

Your CCC helps track your performance over the life of the business. A changing CCC can indicate problems or improvements in your operations, along with its impact on cash flow.

What’s a good CCC number?

Unfortunately, there’s no “magical number” to reach. Cash cycles vary from industry to industry. Instead, it’s helpful to compare yourself to direct competitors, while measuring your CCC number against your own performance over time.

To help you benchmark your own online business, Payability recently surveyed online merchants from North America to understand their current operations and cash cycle.

Our survey asked questions about each stage of their CCC like:

- How they procure inventory

- How long it takes to sell it

- Payment terms with suppliers

Use these results to compare your own company’s operational efficiency to others in your industry. Ask yourself:

- Is your cash flow as efficient?

- Where are you doing better than others?

- What part of your business needs improvement to compete?

1. Purchasing Inventory

The first stage of CCC is how you buy inventory.

Many online sellers (44%) told us they buy their inventory from a wholesaler or distributor. To buy their inventory, large numbers of sellers said they used either a credit card (42%) or debit card (41%).

2. Converting Inventory into Sales

Understanding how quickly you turn inventory into sales is an important factor in improving your CCC. Any type of inventory delays can slow down the time it takes to get products into customers’ hands, and consequently, cash into your business

To store and fulfill orders, almost half of sellers (49%) said they use either Amazon or their own fulfillment solution.

When it comes to inventory, how you store it can have implications for your overall shipping costs and how fast you can deliver to customers.

About 25% of merchants told us they have a delay of at least 7 days in getting their products to warehouses.

26% of sellers say they typically sell their inventory between 14 and 30 days.

Once inventory is sold, about 51% of merchants reported having a 20% to 40% of gross margin profit.

But, CCC is more than just fast inventory turnover. You also have to collect sales in a timely manner so you can continue to invest in and grow your business. Depending on the platform you sell on, funds from your sales can take days or even weeks before they show up in your bank account.

Online marketplaces like Amazon can take weeks to pay out. They hold back part of your balance as a safeguard against customer returns or complaints. This explains their negative CCC.

Long payout delays can slow down your cash cycle and put strain on your business. Your earned cash might not be available when you need it to reinvest in your business.

To overcome long payout schedules that tie up your cash, merchants can turn to solutions like Payability that pay you for your sales the day after you ship. With Payability’s Instant Access, you can get paid next day, every day for your marketplace sales. Get started with Payability now to improve your cashflow.

3. Paying Suppliers for Inventory

The last piece of CCC is how quickly you need to pay suppliers for your inventory.

An overwhelming majority of merchants (72.4%) reported that they are required to pay in full immediately for inventory. Only about 16.6% are able to negotiate terms that allow them to pay back in 15 to 60+ days.

Negotiating better terms with your suppliers can have a positive impact on your CCC.

Better terms could give you more time to invest back into your business before you need to pay suppliers.

How to Improve Your CCC

A lower CCC indicates you’re more efficient at managing your business— you’re quickly moving inventory, collecting cash from sales, and paying back suppliers.

But for many, there’s room for improvement in how you move cash through your business. Here’s two main ways to improve your CCC:

1. Convert Inventory Faster into Cash

The faster you can buy inventory and sell it, the better your cash flow is. And more cash availability means you have means to grow your business.

To lower your CCC and improve cash availability, you should focus on lowering your DIO and/or DSO.

For example: If CCC = 50 + 10 – 30

= 30 days

By lowering DIO from 50 to 40 days, it lowers your CCC from 30 to 20 days.

If CCC = 40 + 10 – 30

= 20 days

2. Extend Time to Pay Suppliers

You can also lower your CCC by extending the time it takes you to pay suppliers, which can work for those who don’t currently have any payment terms.

For example: If CCC = 50 + 10 – 5

= 55 days

By extending DPO from 5 to 30 days, it lowers your CCC from 55 to 30.

If CCC = 50 + 10 – 30

= 30 days

However, extending time to pay your suppliers isn’t always a straightforward tactic.

It’s not necessarily helpful to pay suppliers on long terms (like 90+ days) just for the sake of lowering your CCC. In the long run, this can negatively impact your supplier’s own CCC, which can hurt their ability to fulfill their orders to you.

To overcome this, some suppliers will offer discount terms for paying them early. This allows both parties to benefit from the relationship. You’ll pay the supplier faster (helping their CCC), but at a lower rate that helps lower your overall costs.

Only 17% of merchants receive a discount for paying their suppliers faster.

Of those that do receive a discount, the majority (79%) receive a small discount between 0.1% and 5%.

How Payability Can Help Improve Your CCC

Cash flow is always a challenge of growing an online business. There’s a lot of moving pieces to manage and keep track of, and one mistake can be costly.

When you have Payability Instant Access, you can stop stressing about when you’ll get paid by Amazon for your sales. You’ll get a daily Amazon payout and be in a position to grow your business faster knowing that you’ll get paid out for at least 80% of your sales the day after shipment.

Don’t let Amazon’s long payout schedule tie up your cash. With Payability’s Instant Access, you can get paid next day, every day for your marketplace sales.

Start improving you cash conversion cycle now with Payability now.

Small businesses need anywhere from $10,000 to $80,000 in startup capital. Without it, you can’t finance sales or inventory, which can eventually cost you your business.

With Payability, you can get access to capital when you need it. Funding approval is fast (24-hours) and based on the health of your online business, and not your personal credit history that traditional banks uses. Learn more here.