As an online seller, you already know that cash flow management has its ups and downs. Having steady cash flow is critical to the success and growth of your business. You need to buy inventory, make payroll, and take advantage of opportunities.

As an online seller, you already know that cash flow management has its ups and downs. Having steady cash flow is critical to the success and growth of your business. You need to buy inventory, make payroll, and take advantage of opportunities.

Entrepreneurs have many financing options to raise capital when starting or growing a business. Click here to learn six of the best ways to fund a startup.

Learn about the pros and cons of business loans, how to get a business loan with bad credit, and what you can do if you don’t qualify for a business loan.

Payability does not pull credit scores (business or personal). But, what is a business credit score and how can you find yours?

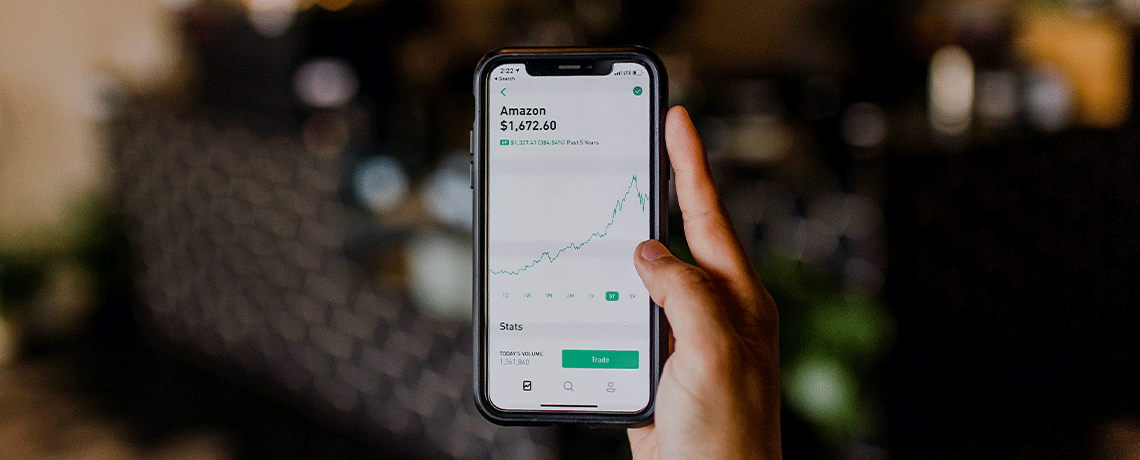

FinTech is transforming everything from small business financing to consumer financing to how we do business in general. But, its impact on eCommerce is significant in so many ways. Let’s explore how FinTech helps increase ROI for SMBs selling online.

In the ecommerce world, there’s nothing more expensive than a missed opportunity. But, if you’re a small business selling online, traditional financing can be hard to come by. Here’s why banks just don’t understand ecommerce entrepreneurs and what you can do about it.

You may know Payability for our flagship product Instant Access where we give sellers daily access to their marketplace payments. However, we also offer Instant Advance which provides sellers with a lump sum of growth capital based on future sales.

It can be difficult to know which products are actually contributing to (or detracting from) your overall profitability, we take a look at three reasons why merchants should track profit at the SKU level.

There are flexible funding options for online sellers to finance business growth and purchase inventory such as how Amazon lending works, Crowdfunding, business credit and more.

Using credit cards to pay for your Amazon inventory is good option depending on interest and how you pay. Here are some pros and cons of using credit for your business.

Having a solid invoice management system can make or break your Amazon seller status. Let us explain: Not only do you rely on invoices to get paid, you may need them to prove to Amazon that your inventory is legitimate — that is, if Amazon or its customers have an issue with one of your products.

Invoice factoring is your secret weapon. It’s a way to turn your revenues into cash faster than normal. Ready to learn more, keep reading…