It’s the beginning of a new year on Amazon and opportunities await for the ambitious Amazon seller. You’re probably looking for new products, tweaking your business, figuring out what to do with leftover holiday inventory, and making adjustments necessary to grow in the new year and comply with ever-changing Amazon policy.

One Amazon policy that isn’t changing any time soon is the payout process, which requires sellers to wait 14 to 28 days after delivery to get paid.

This may lead to you looking for outside funding. Loans and alternative funding might help you cover a round of inventory or two, but ultimately you’ll never grow at the rate you’re capable of if you and your money are stuck in Amazon’s payout process.

A lot of sellers try to work around this by increasing sales volume on their own sites. If you’ve achieved success with this route, congratulations on making it work! But there are still opportunities to profit on Amazon. And as long as you’re selling there, you’ll be waiting weeks after shipping to get paid out for sales, which will impact when you can make your next inventory order.

Faster Payments for Amazon Sales Mean Faster Growth

There is a relatively simple solution, and it isn’t a loan (which, by the way, could come at heavy long-term cost to your eCommerce business).

It’s next-day Amazon payouts from Payability.

Faster payouts come at a cost (fees can go as high as 2% of sales but are typically between .5% and 1%), but the upside is obvious: you take control of your cashflow and grow at a much faster rate without being saddled with any debt or long-term liability.

Let’s look at an example Amazon seller to see this dynamic bear out.

Tim purchased $20,000 of inventory on Jan. 1. He immediately listed the products for sale on his Amazon store. Then, Tim started the year strong. Between Jan. 1 and Jan. 10, Tim sold all of his inventory for $35,000 through his Amazon store. His store sold out.

He clearly has a hit product on his hands, but no cash available to restock. He’s basically stuck waiting for Amazon to pay him in two weeks (or longer). And he can’t do anything to buy more inventory until he has cash-on-hand.

On Jan. 14, Tim’s Amazon statement closes and Tim gets closer to getting paid. Amazon reaches out to say it will pay Tim $20,000 in a few days. But Amazon also says that it is holding $12,000 in account reserve.

Tim does not know when he will receive the remaining $12,000. He’s frustrated. Despite selling out of a hit product, he cannot spend what’s needed on inventory to match market demand and take his business to the next level. Not only that: He’s missing out on opportunities right now.

How faster payments help Tim the seller grow his business faster.

With faster payments from Payability, Tim doesn’t have to wait on Amazon. He can get the money he needs to restock, and then some and reinvest that money back in his business.

After Tim signs up, Payability unlocks all $35,000 of Tim’s Amazon sales and makes $28,000 available for him to use immediately.

By paying a 2% fee ($700), Tim is able to use all $28,000 to purchase more inventory and get his business back up and running. He doesn’t have to wait weeks for Amazon to pay him out. And once the statement period closes, Payability releases the remaining 20% to Tim.

As Tim makes more sales on Amazon, Payability continues to fund him 80% of each day’s sales so that he always has cash-on-hand to spend when new opportunities arise for his business.

Tim gains the ability to grow his business significantly faster when he always has cash-on-hand from Amazon sales.

An even simpler perspective on faster Amazon payments

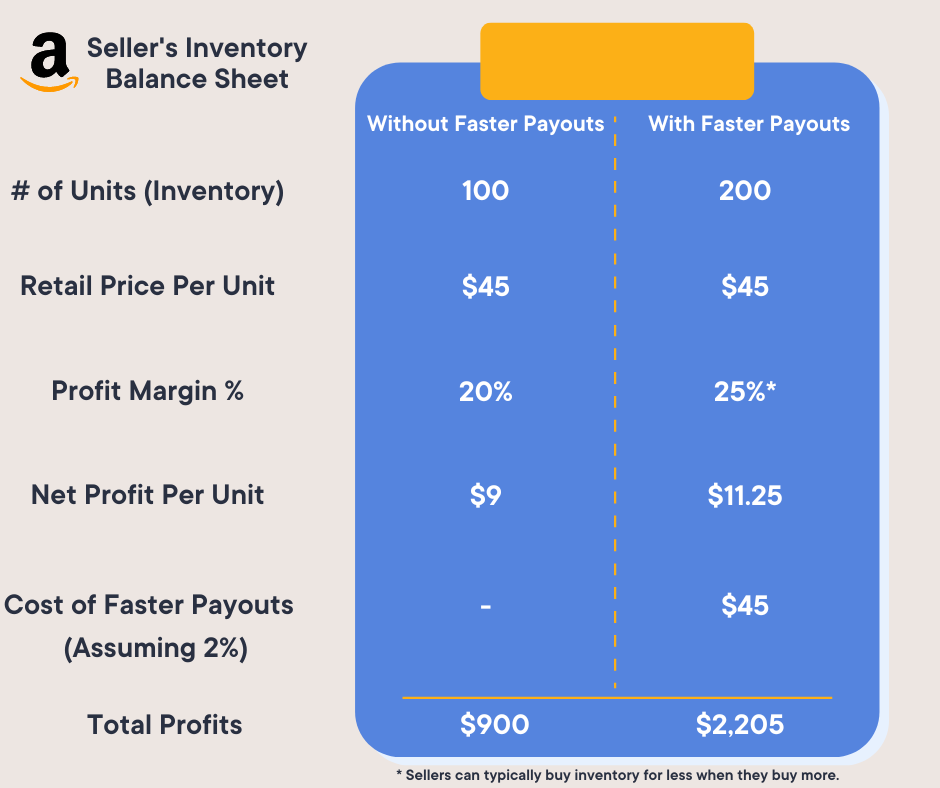

The chart below offers a simplified perspective of how faster payments can lead to faster growth for sellers.

Other Benefits of Faster Payments for Amazon Sales

On Amazon’s typical payment schedule, sellers average two cash cycles per month. With faster payments from Payability, you turn over inventory and cash many, many more times per month, significantly increasing not only your short-term cashflow but also your long-term growth potential.

With faster payments, you can buy inventory more frequently, buy new products in bulk at discounted prices, run promotions on a regular basis, and invest more heavily in marketing campaigns—all proven methods of growth on Amazon. The opportunities are endless—but they only exist if you can get paid faster for your Amazon sales.

Faster payments also allow you to take advantage of unexpected events or time-sensitive trends that may arise throughout the year. For example, if there is a surge in demand during the holiday season or a certain product becomes popular out of nowhere, then faster payments will ensure that you don’t miss out on a golden opportunity—even if you sell out, you have the cash you need to stock up on more and ensure you don’t miss your window for profiting off a hit product.

Take Control of Your Cashflow with Faster Amazon Payments from Payability

The sooner you take control of your cashflow, the sooner you will be maximizing growth for your Amazon business. It’s as simple as that. Getting faster payments from Payability at the beginning of the year ensures that you will have increased cash flow throughout 2023 so that you can invest in growing your business quickly and easily without worrying about budgeting constraints due to slow payment times or money getting stuck in account level reserve. Start 2023 off right by getting faster payments for your Amazon sales from Payability so that you can get ahead and stay ahead this year!

Heads up: Payability works best for sellers doing over $10k sales volume on Amazon per month.